Introduction

In a world that is increasingly digital, one might think that old-fashioned scams like fake checks would be a thing of the past. Unfortunately, that’s far from the truth. Fake check scams remain a significant threat, with perpetrators leveraging both physical and digital platforms to defraud their victims. In this comprehensive post, we will delve into the world of fake check scams, focusing on the infamous Craigslist overpayment scam, and explore how technological solutions like automated check verification systems are providing a line of defense.

What are Fake Check Scams?

Fake check scams are deceptive schemes where fraudsters issue counterfeit or altered checks and manipulate victims into cashing them, often pulling the victims into forwarding a portion of the funds elsewhere. This genre of financial deceit has various forms and methods, yet they all revolve around the exploitation of both the banking system and the trust that people place in it. Here is a closer look at the anatomy of fake check scams.

Brief History

The history of fake check scams dates back to the earliest days of banking. As long as checks have been a medium of exchange, there have been counterfeiters looking to exploit them. However, with the advent of the internet and global communication, the scale and reach of these scams have dramatically increased, targeting unsuspecting individuals across borders.

Anatomy of a Fake Check Scam

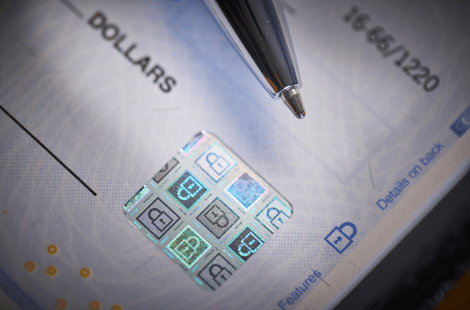

- Check Issuance: The scammer issues a check to the victim. The check often appears legitimate, complete with watermarks, a bank logo, and even matching routing numbers. However, the check is entirely fraudulent or drawn from an account that either doesn’t exist or has insufficient funds.

- Reason for Issuing: Scammers usually have a seemingly valid reason for issuing the check. It could be a fake job offer, a sweepstakes prize, an overpayment for an item you are selling online, or even payment for work you are supposed to perform in the future.

- Request for Fund Transfer: The victim is generally asked to deposit the check into their bank account and then transfer a portion of the amount elsewhere, usually by wire transfer or gift cards.

- Bank Clearance: Banks are usually required to make the funds from deposited checks available within a certain timeframe, often before the check has fully cleared. Victims see the money in their account and believe the check was legitimate.

- Check Bounces: Eventually, the bank identifies the check as fake and reverses the deposit, pulling the full amount back out of the victim’s account.

- Loss Incurred: By this time, the victim has often already sent a portion of the money to the scammer and is left to deal with the financial loss, overdraft fees, and in some cases, legal repercussions.

Types of Fake Check Scams

1. Overpayment Scams:

-

- Description: This is one of the most common types of fake check scams. The scammer pretends to purchase a product or service and sends a check for an amount exceeding the agreed price.

- Modus Operandi: After the victim receives the check, the scammer will come up with a reason for the overpayment and ask the victim to deposit the check and wire back the excess amount. By the time the bank identifies the check as fake, the victim has already sent the “overpaid” amount to the scammer.

- Example: A scammer agrees to purchase a used camera for $300 but sends a check for $500, asking the seller to return the $200 difference.

2. Lottery or Prize Scams:

-

- Description: The victim is informed they’ve won a lottery or prize but must first deposit a check to cover taxes, fees, or other expenses.

- Modus Operandi: The scammer sends a check to cover these costs and asks the victim to deposit it and wire the necessary fees. The check will eventually bounce, and the victim is left covering the entire amount.

- Example: A person receives a letter stating they’ve won a car and must send $2,000 for delivery fees. They’re provided a check for $2,500 and instructed to send back the $2,000.

3. Work-from-Home Scams:

-

- Description: Victims are “hired” for fake jobs and are sent checks to buy supplies, equipment, or to cover initial expenses.

- Modus Operandi: After depositing the check, the victim is instructed to send a portion of the funds to a third party (often the scammer or an accomplice). The original check will bounce, leaving the victim responsible for the full amount.

- Example: A person is hired as a “freelance designer” and receives a check for $3,000 to buy software. They’re instructed to send $1,500 to a “software vendor” but later find out the check was fake.

4. Rental Scams:

-

- Description: Scammers pose as potential tenants and send landlords checks for amounts exceeding the required deposit or rent.

- Modus Operandi: After the check is sent, the scammer will come up with a reason for the overpayment and ask for the excess to be returned. The initial check will bounce, and the landlord is left covering the costs.

- Example: A landlord receives a check for $2,000 for a $1,500 apartment deposit and is asked to return the $500 difference.

5. Mystery Shopping:

-

- Description: Victims are “hired” to evaluate a service, often a money transfer service.

- Modus Operandi: The victim receives a check, is asked to deposit it, and then wire money to a specific location to “evaluate” the service’s efficiency. The check will later bounce.

- Example: A person is hired to evaluate a money transfer service. They’re sent a check for $4,000 and instructed to wire $3,500 to a specific location, keeping $500 as payment.

6. Charity Donation Scams:

-

- Description: Scammers pose as representatives of charitable organizations, asking for donations.

- Modus Operandi: The scammer sends a check to the victim, asking them to deposit it and wire a portion of the funds to the “charity.” The check will eventually bounce.

- Example: A person receives a check for $1,000 and is asked to send $800 to a “charity,” keeping $200 as a token of appreciation.

7. Car Buying Scams:

-

- Description: Scammers express interest in buying cars but send checks for more than the asking price.

- Modus Operandi: The scammer will ask the seller to wire the difference after depositing the check. The check will later be identified as fake.

- Example: A scammer agrees to buy a car for $10,000 but sends a check for $12,000, asking the seller to return the $2,000 difference.

The Psychology Behind the Scam

- Trust in Banking: The scam leverages the general trust that people have in checks and the banking system.

- Timing Gap: Scammers exploit the time it takes for a bank to clear a check versus the time it takes for a victim to see the deposited amount in their account.

- Pressure Tactics: Urgency is often a key component of these scams, compelling the victim to act before they have had adequate time to consider the situation fully.

Real-Case Example: The Craigslist Overpayment Scam

The Craigslist Overpayment Scam is a classic case study for understanding the devious mechanics of fake check scams. This type of scam generally involves someone responding to a classified ad (like those on Craigslist) for goods or services you may be selling. While the scam has been around for years, it continues to dupe unsuspecting victims because of its seemingly logical sequence of events, often backed by convincing fake checks. Let’s delve deeper into the scam, step by step, to understand why it’s so effective.

How the Scam Unfolds

- Initial Contact: You post an item for sale on Craigslist. Soon after, you’re contacted by a prospective buyer.

- Agreement to Buy: The buyer agrees to purchase the item and states that they will send you a check. But instead of sending a check for the agreed-upon sale price, they send one that’s significantly more than the asking price.

- Overpayment Explanation: The buyer usually concocts a believable story to explain the overpayment. This could range from “accidental overpayment” to “extra funds for shipping costs” or even “payment for an agent who will pick up the item.”

- Request for Refund: The buyer asks you to deposit the check and then wire the excess amount back to them or to a third party.

- The Bounced Check: A few days after you wire the money, you find out that the check was fake, and now you are out the wired amount, as the bank will hold you responsible for the entire check amount.

Psychological Manipulation Involved

- Urgency: The buyer often pressures you to act quickly, capitalizing on the sense of urgency to deter you from carefully scrutinizing the check or the buyer’s details.

- Trust: By overpaying, the buyer creates a false sense of trust, implying that they’re so confident in you that they’re willing to send extra money.

- Complexity: The introduction of third parties, such as shipping agents, adds complexity to the transaction and further distracts from the scam at hand.

Red Flags and Common Tactics

- Overpayment in the first place

- High-pressure tactics to act quickly

- Instructions to wire excess funds to a third party

- Usage of a complicated or convoluted process to explain the overpayment

Technological Solution: Automated Check Verification Systems

How They Work

The digitization of banking and financial services has changed the landscape in profound ways, enabling new forms of convenience but also creating avenues for more sophisticated fraud. To combat the pervasive issue of fake check scams, automated check verification systems are at the forefront. In this extended section, we’ll delve into the multiple layers of verification that these systems employ, the technologies powering them, and the advantages and disadvantages of implementing such solutions.

The Anatomy of Automated Check Verification Systems

At a basic level, automated check verification systems scrutinize the check’s details and cross-reference them with a secure database to confirm legitimacy. Here’s a breakdown of the features and technologies often included:

- Digital Signatures: A cryptographic method is used to imprint a unique digital signature on each check. This signature is immutable and is securely stored in a database, which is regularly updated. When a check comes in for verification, the system cross-references this digital signature to confirm if the check is genuine.

- Routing Number Verification: A critical but often overlooked aspect is the verification of the bank’s routing number. The system cross-references this number against a database that includes routing numbers for accredited financial institutions. If a mismatch is found, the check is flagged for further review.

- Machine Learning Algorithms: Modern check verification systems are equipped with machine learning algorithms that evolve with each transaction. These algorithms are programmed to recognize patterns or anomalies in the check details, amounts, or sequences, which would be difficult or time-consuming for a human to identify.

- OCR Technology: Optical Character Recognition (OCR) technology scans the check to identify any alterations in font, handwriting, or formatting that could indicate forgery.

- API Integration: These systems often offer API integrations that allow them to work seamlessly with existing banking or point-of-sale software, thereby enhancing their usability and effectiveness.

Advanced Features

- Real-Time Verification: With advancements in computing and networking speeds, some high-end systems offer real-time verification, where checks are verified instantaneously, dramatically reducing the time window for fraud.

- Blockchain Technology: Some systems are exploring the integration of blockchain to create an immutable ledger of all checks issued, enhancing the security and traceability of each transaction.

- Two-Factor Authentication (2FA): To add an additional layer of security, some systems incorporate 2FA, sending a one-time code to the account holder’s mobile device to confirm the transaction.

- Historical Data Analysis: As these systems amass more transaction data, they become better at predicting and identifying fraudulent activity by analyzing historical trends.

Advantages and Limitations

Advantages:

- Reduced Risk: The multi-layered verification substantially reduces the chances of fraud.

- Efficiency: Automation speeds up the verification process, improving operational efficiency.

- User Experience: Faster and safer transactions result in an enhanced user experience.

Limitations:

- Database Delays: Real-time verification is subject to database update frequencies and bank operating hours.

- Cost: The initial setup and ongoing maintenance of sophisticated systems can be expensive.

- False Positives: No system is foolproof, and there are instances where legitimate transactions might be flagged, requiring manual intervention.